A few principles about money that I really, really like

I’m really interested in money and has always been fascinated by it. But my view on money has changed over the years and last many years as an entrepreneur, money has always been something I thought about as a secondary thing.

“If I just create something cool, the money will come, so no need to focus on money”. That was long my way of thinking, which is now changed to being something that I try to be much more in control of.

I’ve tried to have a lot of debt from a failed startup. I’ve never tried to be super rich, but I have enough money to do what I want, travel, say no to projects and clients and if I wanted I could stop working (or at least stop having an income) for a few years, if I wanted to do something else. Here are some of the financial principles that I have come to really like, principles that are somehow stuck in my approach to money.

Money should be one of your biggest focuses

Of course some people focus too much on money, but in my opinion most people focus too little on it. Money is not the purpose in your life, but it’s the fundation of so many other things. Money is something that you have to take extreme ownership over and be extremely proactive about.

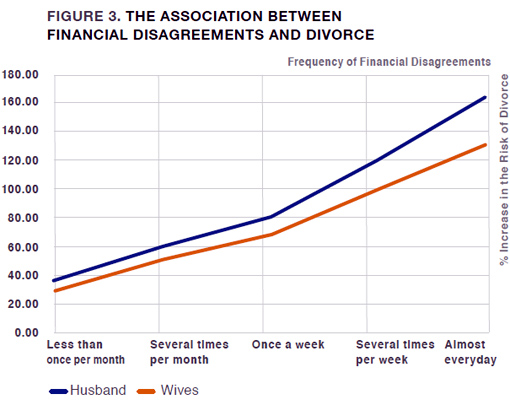

Money is the fundation for a lot of other things. If you have money problems, you will have a lot of other problems. One example is that fighting about money in a relationship predicts divorce rates.

Take extreme ownership of your financial situation

So if money should be one of your biggest focuses and you should take extreme ownership, how do you then do that? Here are some ideas:

- Having or building a reserve fund of money that you can use if your life suddenly changes (lost job for example)

- Understanding your taxes 100%

- Having some principles you follow, fx around how you save up

- Having a long term plan

- Having or building the skills, knowledge and networking to always being able to get work and earning your own money

Knowing your savings rate

The percentage of your income that you save or otherwise invest. That’s a number that I really look at and try to improve, by adjusting how much I spend, but even more with how much I earn. Can you put a side 50% or more of your income and still be able to live a comfortable life, then that will create a lot of freedom for you.

Wealth is what you can’t see

I can’t remember where I read this, but someone defined wealth as “the car you didn’t buy”. Wealth is money in the bank, that gives you direct freedom of your own life, the opportunity to say no and wait for the right options. This quote is another classic (can’t recommend the post in the tweet enough):

“When most people say they want to be a millionaire, what they really mean is “I want to spend a million dollars,” which is literally the opposite of being a millionaire” https://t.co/nwI7LegKyS

— kristina (@kchodorow) June 4, 2018

Living rent free

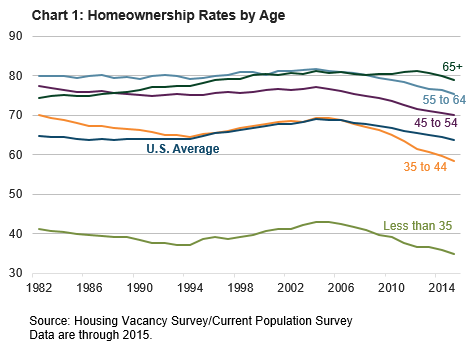

There is a big trend with tiny houses, the whole FIRE movement and so on. Often, people get into these trends like it’s religion and follow them blindly. One thing that a lot of people try to opt out of is owning a home. While there is a lot of good reason to think carefully about buying a home, owning a home has gotten a bad reputation in there has been a decrease in home-ownership (US numbers).

I like traveling and for some years we moved from place to place around the world, but almost all of the time we owned an apartment back home in Copenhagen. I’m super fascinated by the real estate market and I think it’s one of the most important things normal people can do with regards to money. Owning your own place – over the long term and in a big city, gives you a great chance of living somewhere rent-free if you consider the value increase over time.

In my opinion most people don’t think this way, but only think about the cost now. At the same time most people just consider all payments expenses, but it should be split up in expenses (interest, tax, heating, water etc.) and savings (paying off your mortgage).

Before buying the apartment we live in now, we had a long checklist. You can read about the considerations here.

Not having too much on your day-to-day expense account

The account that’s connected to the credit card, that I use for every day stuff like food, clothes, transport etc. I always try to keep the amount that I put into that account low, normally around $800-1000 per month after I have put money aside. This amount is what I spend on money, going out to get a coffee etc.

I try to set this amount at a level, so there is enough to be more than comfortable, but so all shopping I do is doing so with consideration. I never, never just spend $100 on something, without it being thought through.

The gap between FIRE and YOLO

There is a gap between paycheck to paycheck and being what we normally call rich. There is a gap between FIRE and YOLO. There is an alternative to the work extremely hard for some years and enjoy the freedom afterwards. The alternative and the gap is where normal people get rich over long time, without extreme sacrifices and without the need to create their own washing powder.

The alternative is to take extreme ownership of your financial solution, try to earn a bit more than average and try to be smart about money. Those things will – over time – lead to great freedom. It was very late before I realized that myself.

KOMMENTARER

Great post Nikolaj. I agree with you in a lot of your principles.

You might find this book by Tony Robbins interesting (maybe you’ve already read it): https://www.amazon.com/MONEY-Master-Game-Financial-Freedom-ebook/dp/B00MZAIU4G

It personally made a paradigm shift for me regarding money, savings and have to achieve financial freedom.